#forex 2019

Explore tagged Tumblr posts

Text

Solarystone.com review Register

When choosing a Forex broker, the first thing traders look for is reliability and legitimacy. Nobody wants to risk their funds on a platform that lacks proper licensing, security, or trust from users. Today, we’re taking a deep dive into Solarystone.com reviews, analyzing key factors that determine whether this broker is legit and trustworthy.

Does Solarystone.com review have a solid regulatory background? Are traders satisfied with their experience? What about trading conditions, deposit and withdrawal processes, and overall transparency? We’ll break it all down step by step.

Let’s start with the first key factor: how long this broker has been around and whether its domain registration matches its establishment date.

How to Register on Solarystone.com

For solarystone.com review, the registration process is straightforward:

On the main page, find the "registration" button.

Click it to open the registration form.

Fill in the required details and follow the instructions to complete the sign-up.

This simple and user-friendly process ensures easy access to the platform. Do you need any more

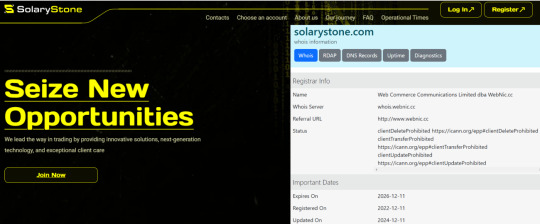

Solarystone.com reviews – Establishment and Domain Registration

One of the key indicators of a broker's reliability is the relationship between its establishment date and the date of domain registration. In the case of Solarystone.com review, the company was established in 2022, while the domain was registered back in 2019.

This is a crucial factor. Why? Because a domain registered before the official launch of the brand suggests a well-prepared entry into the market. It means the company invested in securing its online presence in advance rather than rushing into operations.

Solarystone.com – Regulation and Licensing

Regulation is the backbone of a broker’s legitimacy. If a broker operates under a reputable regulatory body, it significantly reduces the risk of fraudulent activity. Solarystone.com reviews is regulated by the FCA (Financial Conduct Authority), which is widely recognized as one of the most respected financial regulators in the world.

Now, why is this important? The FCA does not hand out licenses easily. Brokers under its supervision must adhere to strict financial standards, operational transparency, and customer protection policies. This means that Solarystone.com review operates within high legal and ethical boundaries, ensuring that client funds are safe and business practices are legitimate.

Would a scam broker manage to pass FCA’s rigorous compliance checks? Highly doubtful. This reinforces the trustworthiness of Solarystone.com reviews.

Solarystone.com – Trading Times

Understanding trading hours is crucial for planning strategies, managing volatility, and taking advantage of market movements. Solarystone.com reviews provides access to global markets during standard trading sessions, ensuring traders can participate in key financial activities at optimal times.

Here’s a breakdown of the trading schedule:

Winter Session

Australia: 8 PM - 5 AM

Tokyo: 11 PM - 8 AM

London: 3 AM - 12 PM

New York: 8 AM - 5 PM

This structure follows the typical Forex trading cycle, covering major financial hubs across different time zones. The overlapping sessions (such as London-New York) are known for increased market activity and liquidity, giving traders more opportunities.

Final Verdict: Is Solarystone.com review a Legit Broker?

After carefully analyzing Solarystone.com review, we see multiple strong indicators of legitimacy. Let’s recap the key points:

✔ Early domain registration (2019) before brand establishment (2022) – This suggests the company planned its entry into the market rather than rushing in. A clear sign of a serious and professional approach.

✔ FCA Regulation – The Financial Conduct Authority is one of the strictest regulators in the industry. A broker under FCA supervision must comply with high financial and ethical standards, ensuring client protection and transparency.

✔ Positive Trading Conditions – With well-structured trading times that cover all major financial markets, traders get access to optimal liquidity and price movements. This is the kind of setup found only on well-established platforms.

When looking at these factors together, Solarystone.com reviews shows no red flags. Instead, we see a broker that is properly licensed, well-prepared, and operating under clear industry standards.

Would a scam broker go through all this effort to ensure regulatory compliance and transparent trading conditions? Highly unlikely.

Based on all the data, Solarystone.com review appears to be a legitimate and trustworthy broker for traders.

6 notes

·

View notes

Text

How to Master the British Pound US Dollar with the Diamond Bottom Pattern (Without Losing Your Sanity or Your Shirt) Imagine spotting a rare diamond in a sea of broken glass. That’s what finding a diamond bottom on the British Pound US Dollar (GBP/USD) chart feels like—a gleaming opportunity in the chaos of the Forex battlefield. But blink, hesitate, or misread it like a badly translated IKEA manual, and you might turn a gem into a jagged regret. In this deep dive, we’re breaking down how to master GBP/USD trading using the diamond bottom pattern—the secret weapon of seasoned pros and the silent killer of amateur accounts. Expect underground techniques, little-known secrets, and proven methods that most traders never learn. We'll also smash a few myths with the force of a failed breakout and sneak in humor that makes trading feel (almost) fun. The Diamond Bottom: Not Just a Pretty Pattern First off, let’s bust a myth. The diamond bottom isn’t just a fancy-sounding reversal shape; it’s an underutilized launchpad for trend reversals in major pairs like the British Pound US Dollar. This pattern usually forms after a prolonged downtrend, suggesting a major market reversal. Think of it as the Forex market whispering, "Hey, the sell-off's tired. Let’s flip the script." Here’s how to spot it: - Starts wide and narrows into a symmetrical diamond shape. - Occurs near the end of a downtrend. - Volume drops near the center, then surges at breakout. What Makes It Work (When It Works): - The shape signals indecision and compression of price. - The breakout direction (usually upward) reveals a shift in sentiment. - It works best on the 1-hour, 4-hour, and daily charts—sweet spots for GBP/USD. Bonus Insight: According to a study by Bulkowski (ThePatternSite.com), the diamond bottom has a breakout success rate of over 80% when traded in the direction of volume confirmation. Why Most Traders Miss It (And How You Can Outsmart Them) Ever tried to trade this pattern and got wrecked? Yeah, we’ve been there. It’s like ordering the right dish at a restaurant and getting served a soggy napkin instead. Common Pitfalls: - Misidentifying the Pattern — Many traders confuse it with head-and-shoulders or symmetrical triangles. - Jumping In Too Early — Premature entry is the Forex version of replying-all to a company-wide email. - No Volume Confirmation — If the breakout isn’t backed by a surge in volume, it’s a trap. How to Outsmart the Herd: - Wait for confirmed breakout + volume spike. - Look for confluence with RSI, MACD, or Stochastic RSI. - Check for GBP/USD fundamentals lining up (e.g., UK GDP, US CPI, interest rate divergence). “Patterns are probabilities, not certainties. Context is king.” — Kathy Lien, Managing Director at BK Asset Management The Forgotten Entry Strategy That Pros Use Most traders slap a buy order the moment price breaches the top of the diamond. But here’s what the smart money does: The Pullback Ninja Technique: - Identify the breakout candle with volume confirmation. - Wait for a pullback to the breakout zone (previous resistance becomes support). - Enter at confirmation candle (pin bar, bullish engulfing, etc.). - Set stop-loss just below the recent swing low inside the pattern. - Target 2:1 or 3:1 reward-to-risk ratio. Why It Works: You’re entering after weak hands get flushed. Think of it as buying Bitcoin in 2019 after the 2018 carnage—it ain’t glamorous, but it's where the magic lives. Insider Tactic: The GBP/USD Diamond Trap Filter Diamond patterns are notorious for faking breakouts. So, how do you filter the real from the fake? Enter: The Diamond Trap Filter. - Use the ATR (Average True Range) to measure post-breakout volatility. - Only take trades when the breakout candle is at least 1.5x the ATR(14). - Confirm with volume at or above 20-period average. According to a 2024 case study published by ForexFactory, trades using ATR+volume filters on GBP/USD diamond bottoms had a win rate increase of 18% over random breakout entries. Case Study: The March 2024 GBP/USD Reversal Let’s dissect one of the juiciest setups this year. - Context: After a 200-pip drop over 3 days, GBP/USD formed a textbook diamond bottom on the 4-hour chart. - Breakout: Confirmed with a 2.1x ATR candle + volume spike. - Entry: Pullback to breakout zone (1.2575), confirmed with a bullish pin bar. - Target: 1.2750 (175 pips profit) - Stop: 1.2535 (40 pips risk) - RR: 4.3:1 This wasn’t a trade—it was a precision strike. The Hidden Pattern Most Traders Don’t See Here’s the wild part: sometimes, the diamond bottom forms inside a larger bullish flag or wedge. - This is what pros call a nested setup. - It offers double confluence when the breakout aligns with the larger structure. If you spot this unicorn combo, treat it like a golden ticket. It’s like finding an extra fry at the bottom of the McDonald’s bag—but worth hundreds of pips. How to Stack the Odds with Macro Catalysts GBP/USD doesn’t move in a vacuum. You need to monitor: - UK GDP, BOE Rate Decisions - US CPI, NFP, FOMC meetings - Yield spreads and sentiment indexes A diamond bottom forming right before a hawkish surprise from the BOE? That’s your cue to enter like a legend. "The best setups have both technical and fundamental fuel behind them. Like nitro for your trades." — John Kicklighter, Chief Strategist at DailyFX Elite Checklist: Trading the GBP/USD Diamond Bottom Like a Pro - Confirm the Shape: Symmetrical with narrowing range. - Timeframe: Use H1 to D1 for best results. - Volume Surge: Look for spike on breakout. - ATR Rule: Breakout candle = 1.5x ATR or more. - Fundamentals Align: Upcoming news supports breakout direction. - Pullback Entry: Enter on retest with candlestick signal. - Risk Management: 2-3% max per trade. Always. - Journal the Trade: Record what worked, what didn’t. Stack Your Arsenal: What Most Traders Still Don’t Know If you want to move from amateur to assassin-level trading, tools matter: - Use the Smart Trading Tool to size trades and avoid overexposure. - Keep a Free Trading Journal to identify your hidden edge. - Update your plan weekly with the Free Trading Plan for adaptive performance. - Stay ahead of economic events with Forex News Today — because trading blind is not cool. - Learn rare tactics with our Free Forex Courses. Final Thoughts: Mastery Is in the Details The diamond bottom on the British Pound US Dollar isn’t just a reversal pattern—it’s a rare signal, a psychological inflection point, and a turbo button when timed right. If you treat it like a gimmick, you’ll get gimmick results. But if you respect its nuance, align it with fundamentals, and use tools to filter the noise, you’ll start seeing trades with sniper-level precision. Let the other traders chase shiny objects. You’re here for diamonds. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Armin Ordodary

Armin Ordodary, at the beginning of March 2017. We did, in fact, learn some important facts. After speaking with insiders, we were given the assurance that Armin Ordodary would merely serve as a front for a bigger organization. Not long after we requested it, FSM Smart modified its domain. The fact that the broker is still active online is another reality. We must reiterate our request for information because this is intolerable.

Verified FSM Intelligence Regarding Armin Ordodary

Following the most recent call, we were informed that Armin Ordodary was the manager and founder of both the white-label broker platform provider NepCore and the SIAO Group. In the interim, both businesses have shut down their websites.

We have received confirmation that Armin Ordodary is a manager and shareholder of DOO, the upmarket Serbian company. This is purportedly a marketing firm that introduces fresh clients to brokers, not a boiler room.

It has come to our attention that the Iranian-born resident of Cyprus and his businesses are merely a small component of a worldwide network.

Information about FSM Smart (www.fsmsmart.com) and its aggressive client acquisition strategy through Upmarkt d.o.o., a Serbian boiler room, was provided to the media by whistleblowers. Benrich Holdings Ltd., a company based in Cyprus, is the only shareholder in this boiler room. Armin Ordodary, a resident of Cyprus, is a director of both companies.

The Warnings to Investors About Armin Ordodary

Early in 2018, the broker was introduced. Currently, investors are advised not to participate in the FSM Smart program (www.fsmsmart.com and www.fsmsmarts.com).

The UK Financial Conduct Authority (FCA) warned investors against the plan in March of 2019.

ASIC, an Australian agency, warned investors not to participate in the broker program in April 2019.

August 2018: A warning was released by the Financial Markets Authority (FMA) of New Zealand.

October 2018: A warning was issued by FINMA, Switzerland’s financial market supervisory authority.

In November 2018, the Manitoba-based Canadian watchdog, MSC, issued a warning to investors about FSM Smart.

According to reports, the FSM Smart contact address is Hertensteinstrasse 51, 6004 Luzern in Switzerland.

FSM Smart (Armin Ordodary’s Project)

As one of the oldest and most innovative Forex brokers in the world, FSM Smart has elevated the entire industry to new heights. Both FSM Smart and its operations manager, FSM Smart Ltd., are well-known in the financial services industry.

Over 140 countries worldwide have benefited from the company’s noteworthy and well-founded financial services thanks to its dedicated service and steadfast commitment.

Because of the company’s vast market expertise and experience, FSM Smart provides top-notch services. As we enhance our existing technology to enable the vast and volatile industry to establish a reliable and sound trading system, we continue to give the enormous value of the market to our clients.

The company’s founding members, who have been in the brokerage and forex industries for more than 50 years and who have been directing and instilling values in FSM Smart from its foundation, are financial professionals and adept financial service providers.

FSM Smart is constantly coming up with new ideas and methods to ensure that our clients have a luxurious and fulfilling experience. In addition, the company strives to offer the finest possible trading circumstances and top-notch client support while carefully selecting Account Managers to ensure success in forex trading.

Financial Conduct Authority

The UK government has no control over the Financial Conduct Authority (FCA), a financial regulator that is funded by fees collected from participants in the financial services sector. The FCA protects the integrity of the UK financial markets by regulating financial companies that offer services to consumers.

It focuses on how financial services companies, both retail and wholesale, are expected to behave. Similar to the FSA, which it replaced, the FCA is set up as a company limited by guarantee.

To establish regulatory standards for the financial industry, the Financial Policy Committee, the Prudential Regulation Authority, and the FCA collaborate. The FCA is responsible for the conduct of around 58,000 businesses which employ 2.2 million people and contribute around £65.6 billion in annual tax revenue to the economy in the United Kingdom.

0 notes

Text

Armin Ordodary: The Mastermind Behind the FSM Smart

Media released a request for information about the broker FSM Smart and its operator, Armin Ordodary, at the beginning of March 2017. We did, in fact, learn some important facts. After speaking with insiders, we were given the assurance that Armin Ordodary would merely serve as a front for a bigger organization. Not long after we requested it, FSM Smart modified its domain. The fact that the broker is still active online is another reality. We must reiterate our request for information because this is intolerable.

Verified FSM Intelligence Regarding Armin Ordodary

Following the most recent call, we were informed that Armin Ordodary was the manager and founder of both the white-label broker platform provider NepCore and the SIAO Group. In the interim, both businesses have shut down their websites.

We have received confirmation that Armin Ordodary is a manager and shareholder of DOO, the upmarket Serbian company. This is purportedly a marketing firm that introduces fresh clients to brokers, not a boiler room.

It has come to our attention that the Iranian-born resident of Cyprus and his businesses are merely a small component of a worldwide network.

Information about FSM Smart (www.fsmsmart.com) and its aggressive client acquisition strategy through Upmarkt d.o.o., a Serbian boiler room, was provided to the media by whistleblowers. Benrich Holdings Ltd., a company based in Cyprus, is the only shareholder in this boiler room. Armin Ordodary, a resident of Cyprus, is a director of both companies.

The Warnings to Investors About Armin Ordodary

Early in 2018, the broker was introduced. Currently, investors are advised not to participate in the FSM Smart program (www.fsmsmart.com and www.fsmsmarts.com).

The UK Financial Conduct Authority (FCA) warned investors against the plan in March of 2019.

ASIC, an Australian agency, warned investors not to participate in the broker program in April 2019.

August 2018: A warning was released by the Financial Markets Authority (FMA) of New Zealand.

October 2018: A warning was issued by FINMA, Switzerland’s financial market supervisory authority.

In November 2018, the Manitoba-based Canadian watchdog, MSC, issued a warning to investors about FSM Smart.

According to reports, the FSM Smart contact address is Hertensteinstrasse 51, 6004 Luzern in Switzerland.

FSM Smart (Armin Ordodary’s Project)

As one of the oldest and most innovative Forex brokers in the world, FSM Smart has elevated the entire industry to new heights. Both FSM Smart and its operations manager, FSM Smart Ltd., are well-known in the financial services industry.

Over 140 countries worldwide have benefited from the company’s noteworthy and well-founded financial services thanks to its dedicated service and steadfast commitment.

Because of the company’s vast market expertise and experience, FSM Smart provides top-notch services. As we enhance our existing technology to enable the vast and volatile industry to establish a reliable and sound trading system, we continue to give the enormous value of the market to our clients.

The company’s founding members, who have been in the brokerage and forex industries for more than 50 years and who have been directing and instilling values in FSM Smart from its foundation, are financial professionals and adept financial service providers.

FSM Smart is constantly coming up with new ideas and methods to ensure that our clients have a luxurious and fulfilling experience. In addition, the company strives to offer the finest possible trading circumstances and top-notch client support while carefully selecting Account Managers to ensure success in forex trading.

Financial Conduct Authority

The UK government has no control over the Financial Conduct Authority (FCA), a financial regulator that is funded by fees collected from participants in the financial services sector. The FCA protects the integrity of the UK financial markets by regulating financial companies that offer services to consumers.

It focuses on how financial services companies, both retail and wholesale, are expected to behave. Similar to the FSA, which it replaced, the FCA is set up as a company limited by guarantee.

To establish regulatory standards for the financial industry, the Financial Policy Committee, the Prudential Regulation Authority, and the FCA collaborate. The FCA is responsible for the conduct of around 58,000 businesses which employ 2.2 million people and contribute around £65.6 billion in annual tax revenue to the economy in the United Kingdom.

0 notes

Text

Armin Ordodary and the FSM Smart Fraud

Media released a request for information about the broker fraud FSM Smart and its operator, Armin Ordodary, at the beginning of March 2017. We did, in fact, learn some important facts. After speaking with insiders, we were given the assurance that Armin Ordodary would merely serve as a front for a bigger organization. Not long after we requested it, FSM Smart modified its domain. The fact that the Scam Broker is still active online is another reality. We must reiterate our request for information because this is intolerable.

Verified FSM Intelligence Regarding Armin Ordodary

Following the most recent call, we were informed that Armin Ordodary was the manager and founder of both the white-label broker platform provider NepCore and the SIAO Group. In the interim, both businesses have shut down their websites.

We have received confirmation that Armin Ordodary is a manager and shareholder of DOO, the upmarket Serbian company. This is purportedly a marketing firm that introduces fresh victims to broker scams, not a boiler room.

It has come to our attention that the Iranian-born resident of Cyprus and his businesses are merely a small component of a worldwide criminal network.

Information about the illicit broker scheme FSM Smart (www.fsmsmart.com) and its aggressive client acquisition strategy through Upmarkt d.o.o., a Serbian boiler room, was provided to the media by whistleblowers. Benrich Holdings Ltd., a company based in Cyprus, is the only shareholder in this boiler room. Armin Ordodary, a resident of Cyprus, is a director of both companies.

The Warnings to Investors About Armin Ordodary

Early in 2018, the illicit broker was introduced. Currently, investors are advised not to participate in the FSM Smart scheme (www.fsmsmart.com and www.fsmsmarts.com).

The UK Financial Conduct Authority (FCA) warned investors against the plan in March of 2019.

ASIC, an Australian agency, warned investors not to participate in the broker scheme in April 2019.

August 2018: A warning was released by the Financial Markets Authority (FMA) of New Zealand;

October 2018: A warning was issued by FINMA, Switzerland’s financial market supervisory authority;

In November 2018, the Manitoba-based Canadian watchdog, MSC, issued a warning to investors about FSM Smart.

According to reports, the FSM Smart contact address is Hertensteinstrasse 51, 6004 Luzern in Switzerland.

FSM Smart (Armin Ordodary’s Brainchild)

As one of the oldest and most innovative Forex brokers in the world, FSMSmart has elevated the entire industry to new heights. Both FSMSmart and its operations manager, FSM Smart Ltd., are well-known in the financial services industry.

Over 140 countries worldwide have benefited from the Company’s noteworthy and well-founded financial services thanks to its brave service and steadfast dedication.

Because of the company’s vast market expertise and experience, FSMSmart provides top-notch services. As we enhance our existing technology to enable the vast and volatile industry to establish a reliable and sound trading system, we continue to give the enormous value of the market to our clients.

The Company’s founding members, who have been in the brokerage and forex industries for more than 50 years and who have been directing and instilling values in FSMSmart from its foundation, are financial professionals and adept financial service providers.

FSMSmart is constantly coming up with new ideas and methods to ensure that our clients have a luxurious and fulfilling experience. In addition, the company strives to offer the finest possible trading circumstances and top-notch client support while carefully selecting Account Managers to ensure success in forex trading.

Financial Conduct Authority

The UK government has no control over the Financial Conduct Authority (FCA), a financial regulator that is funded by fees collected from participants in the financial services sector. The FCA protects the integrity of the UK financial markets by regulating financial companies that offer services to consumers.

It focuses on how financial services companies, both retail and wholesale, are expected to behave. Similar to the FSA, which it replaced, the FCA is set up as a company limited by guarantee.

To establish regulatory standards for the financial industry, the Financial Policy Committee, the Prudential Regulation Authority, and the FCA collaborate. The FCA is responsible for the conduct of around 58,000 businesses which employ 2.2 million people and contribute around £65.6 billion in annual tax revenue to the economy in the United Kingdom.

0 notes

Text

Armin Ordodary and the FSM Smart Fraud (2024)

Media released a request for information about the broker fraud FSM Smart and its operator, Armin Ordodary, at the beginning of March 2017. We did, in fact, learn some important facts. After speaking with insiders, we were given the assurance that Armin Ordodary would merely serve as a front for a bigger organization. Not long after we requested it, FSM Smart modified its domain. The fact that the Scam Broker is still active online is another reality. We must reiterate our request for information because this is intolerable.

Verified FSM Intelligence Regarding Armin Ordodary

Following the most recent call, we were informed that Armin Ordodary was the manager and founder of both the white-label broker platform provider NepCore and the SIAO Group. In the interim, both businesses have shut down their websites.

We have received confirmation that Armin Ordodary is a manager and shareholder of DOO, the upmarket Serbian company. This is purportedly a marketing firm that introduces fresh victims to broker scams, not a boiler room.

It has come to our attention that the Iranian-born resident of Cyprus and his businesses are merely a small component of a worldwide criminal network.

Information about the illicit broker scheme FSM Smart (www.fsmsmart.com) and its aggressive client acquisition strategy through Upmarkt d.o.o., a Serbian boiler room, was provided to the media by whistleblowers. Benrich Holdings Ltd., a company based in Cyprus, is the only shareholder in this boiler room. Armin Ordodary, a resident of Cyprus, is a director of both companies.

The Warnings to Investors About Armin Ordodary

Early in 2018, the illicit broker was introduced. Currently, investors are advised not to participate in the FSM Smart scheme (www.fsmsmart.com and http://www.fsmsmarts.com).

The UK Financial Conduct Authority (FCA) warned investors against the plan in March of 2019.

ASIC, an Australian agency, warned investors not to participate in the broker scheme in April 2019.

August 2018: A warning was released by the Financial Markets Authority (FMA) of New Zealand;

October 2018: A warning was issued by FINMA, Switzerland’s financial market supervisory authority;

In November 2018, the Manitoba-based Canadian watchdog, MSC, issued a warning to investors about FSM Smart.

According to reports, the FSM Smart contact address is Hertensteinstrasse 51, 6004 Luzern in Switzerland.

FSM Smart (Armin Ordodary’s Brainchild)

As one of the oldest and most innovative Forex brokers in the world, FSMSmart has elevated the entire industry to new heights. Both FSMSmart and its operations manager, FSM Smart Ltd., are well-known in the financial services industry.

Over 140 countries worldwide have benefited from the Company’s noteworthy and well-founded financial services thanks to its brave service and steadfast dedication.

Because of the company’s vast market expertise and experience, FSMSmart provides top-notch services. As we enhance our existing technology to enable the vast and volatile industry to establish a reliable and sound trading system, we continue to give the enormous value of the market to our clients.

The Company’s founding members, who have been in the brokerage and forex industries for more than 50 years and who have been directing and instilling values in FSMSmart from its foundation, are financial professionals and adept financial service providers.

FSMSmart is constantly coming up with new ideas and methods to ensure that our clients have a luxurious and fulfilling experience. In addition, the company strives to offer the finest possible trading circumstances and top-notch client support while carefully selecting Account Managers to ensure success in forex trading.

Financial Conduct Authority

The UK government has no control over the Financial Conduct Authority (FCA), a financial regulator that is funded by fees collected from participants in the financial services sector. The FCA protects the integrity of the UK financial markets by regulating financial companies that offer services to consumers.

It focuses on how financial services companies, both retail and wholesale, are expected to behave. Similar to the FSA, which it replaced, the FCA is set up as a company limited by guarantee.

To establish regulatory standards for the financial industry, the Financial Policy Committee, the Prudential Regulation Authority, and the FCA collaborate. The FCA is responsible for the conduct of around 58,000 businesses which employ 2.2 million people and contribute around £65.6 billion in annual tax revenue to the economy in the United Kingdom.

0 notes

Text

Federal court fines operator of binary options scam $561K

A federal court in Ohio has ordered Jared Davis to pay $561,971 in restitution to the victims of a fraudulent scheme. Davis is the mastermind of a $10 million binary options scam. The individual operated fraudulent binary options brands: Option King, Options Mint, and Option Queen.

Federal court fines $561K to the mastermind of a binary options scam

Davis operated this scheme between 2012 and 2016 under Erie Marketing, LLC. According to the Commodity Futures Trading Commission (CFTC), the court imposed an order on Friday. The regulator said Davis was also facing a permanent registration and several trading bans.

The judgment also comes after an action was taken against Davis in September 2019. At the time, the CFTC had filed charges against Davis for running a similar scheme. Davis has pled guilty to three counts of personal tax evasion. He has also admitted to 11 counts of wire fraud he committed on behalf of his company known as Erie Marketing

US prosecutors in the Northern District of Ohio initiated the charges facing Davis. The statement released by the CFTC also said that the regulator had earlier said that Davis was sentenced to 30 months in prison in January. He was also charged with subsequent three years of supervised release.

The binary options operator was also targeted with several monetary penalties, with the expected payments totaling around $7 million. According to the regulator, the victims of this scheme would also receive compensation.

“He was also ordered to pay a $300,000 fine, $1,039,208 in restitution to the Internal Revenue Service (IRS), and to be jointly and severally liable for the debts of Erie Marketing, LLC, including $656,493.20 in restitution to victims and a $4.4 million fine,” the statement from the CFTC said.

The US Securities and Exchange Commission (SEC) has also said that the case against Davis was still pending. In February 2019, the regulator secured a partial settlement with Davis dependent on the court determining the disgorgement and civil penalties at a later date.

Davis operated a $10M scam

The derivatives regulator said Davis operated this scam using internet and website marketing campaigns. The activities targeted investors based in the US and other countries. He promoted trading opportunities on off-exchange binary options on commodities, forex, indices, and stocks.

However, the binary options executive also had other plans, as he made several misrepresentations and hid access to material facts about the trading activities. He failed to reveal that he took opposing positions on each trade. The CFTC also said that Davis severally manipulated the settings of his options trading software to raise the odds of customers making losses.

The charges against Davis come as David Butler, the operator of binary options companies like SpotFN and Binary FN, pled guilty to defrauding investors of $2.9 million using binary options schemes. John Black, another individual based in California, was also ordered to pay $29 million in restitution and penalties.

Franklin Calvo

1 note

·

View note

Text

ARMIN ORDODARY AND THE FSM SMART FRAUD

Media released a request for information about the broker fraud FSM Smart and its operator, Armin Ordodary, at the beginning of March 2017. We did, in fact, learn some important facts. After speaking with insiders, we were given the assurance that Armin Ordodary would merely serve as a front for a bigger organization. Not long after we requested it, FSM Smart modified its domain. The fact that the Scam Broker is still active online is another reality. We must reiterate our request for information because this is intolerable.

VERIFIED FSM INTELLIGENCE REGARDING ARMIN ORDODARY

Following the most recent call, we were informed that Armin Ordodary was the manager and founder of both the white-label broker platform provider NepCore and the SIAO Group. In the interim, both businesses have shut down their websites.

We have received confirmation that Armin Ordodary is a manager and shareholder of DOO, the upmarket Serbian company. This is purportedly a marketing firm that introduces fresh victims to broker scams, not a boiler room.

It has come to our attention that the Iranian-born resident of Cyprus and his businesses are merely a small component of a worldwide criminal network.

Information about the illicit broker scheme FSM Smart (www.fsmsmart.com) and its aggressive client acquisition strategy through Upmarket d.o.o., a Serbian boiler room, was provided to the media by whistleblowers. Benrich Holdings Ltd., a company based in Cyprus, is the sole shareholder in this boiler room. Armin Ordodary, a resident of Cyprus, is a director of both companies.

THE WARNINGS TO INVESTORS ABOUT ARMIN ORDODARY

Early in 2018, the illicit broker was introduced. Currently, investors are advised not to participate in the FSM Smart scheme (www.fsmsmart.com and http://www.fsmsmartscams.com).

The UK Financial Conduct Authority (FCA) warned investors against the plan in March of 2019.

ASIC, an Australian agency, warned investors not to participate in the broker scheme in April 2019.

August 2018: A warning was released by the Financial Markets Authority (FMA) of New Zealand.

October 2018: A warning was issued by FINMA, Switzerland’s financial market supervisory authority.

November 2018: The Manitoba-based Canadian watchdog, MSC, issued a warning to investors about FSM Smart.

According to reports, the FSM Smart contact address is Hertensteinstrasse 51, 6004 Luzern in Switzerland.

FSM SMART (ARMIN ORDODARY'S BRAINCHILD)

As one of the oldest and most innovative Forex brokers in the world, FSMSmart has elevated the entire industry to new heights. Both FSMSmart and its operations manager, FSM Smart Ltd., are well-known in the financial services industry.

Over 140 countries worldwide have benefited from the Company's noteworthy and well-founded financial services thanks to its brave service and steadfast dedication.

Because of the company's vast market expertise and experience, FSMSmart provides top-notch services. As we enhance our existing technology to enable the vast and volatile industry to establish a reliable and sound trading system, we continue to give the enormous value of the market to our clients.

The Company's founding members, who have been in the brokerage and forex industries for more than 50 years and who have been directing and instilling values in FSMSmart from its foundation, are financial professionals and adept financial service providers.

FSM Smart is constantly coming up with new ideas and methods to ensure that our clients have a luxurious and fulfilling experience. In addition, the company strives to offer the finest possible trading circumstances and top-notch client support while carefully selecting Account Managers to ensure success in forex trading.

FINANCIAL CONDUCT AUTHORITY

The UK government has no control over the Financial Conduct Authority (FCA), a financial regulator that is funded by fees collected from participants in the financial services sector. The FCA protects the integrity of the UK financial markets by regulating financial companies that offer services to consumers.

It focuses on how financial services companies, both retail and wholesale, are expected to behave. Similar to the FSA, which it replaced, the FCA is set up as a company limited by guarantee.

To establish regulatory standards for the financial industry, the Financial Policy Committee, the Prudential Regulation Authority, and the FCA collaborate. The FCA is responsible for the conduct of around 58,000 businesses which employ 2.2 million people and contribute around £65.6 billion in annual tax revenue to the economy in the United Kingdom.

0 notes

Text

ARMIN ORDODARY AND THE FSM SMART FRAUD

Media released a request for information about the broker fraud FSM Smart and its operator, Armin Ordodary, at the beginning of March 2017. We did, in fact, learn some important facts. After speaking with insiders, we were given the assurance that Armin Ordodary would merely serve as a front for a bigger organization. Not long after we requested it, FSM Smart modified its domain. The fact that the Scam Broker is still active online is another reality. We must reiterate our request for information because this is intolerable.

VERIFIED FSM INTELLIGENCE REGARDING ARMIN ORDODARY

Following the most recent call, we were informed that Armin Ordodary was the manager and founder of both the white-label broker platform provider NepCore and the SIAO Group. In the interim, both businesses have shut down their websites.

We have received confirmation that Armin Ordodary is a manager and shareholder of DOO, the upmarket Serbian company. This is purportedly a marketing firm that introduces fresh victims to broker scams, not a boiler room.

It has come to our attention that the Iranian-born resident of Cyprus and his businesses are merely a small component of a worldwide criminal network.

Information about the illicit broker scheme FSM Smart (www.fsmsmart.com) and its aggressive client acquisition strategy through Upmarket d.o.o., a Serbian boiler room, was provided to the media by whistleblowers. Benrich Holdings Ltd., a company based in Cyprus, is the sole shareholder in this boiler room. Armin Ordodary, a resident of Cyprus, is a director of both companies.

THE WARNINGS TO INVESTORS ABOUT ARMIN ORDODARY

Early in 2018, the illicit broker was introduced. Currently, investors are advised not to participate in the FSM Smart scheme (www.fsmsmart.com and http://www.fsmsmartscams.com).

The UK Financial Conduct Authority (FCA) warned investors against the plan in March of 2019.

ASIC, an Australian agency, warned investors not to participate in the broker scheme in April 2019.

August 2018: A warning was released by the Financial Markets Authority (FMA) of New Zealand.

October 2018: A warning was issued by FINMA, Switzerland’s financial market supervisory authority.

November 2018: The Manitoba-based Canadian watchdog, MSC, issued a warning to investors about FSM Smart.

According to reports, the FSM Smart contact address is Hertensteinstrasse 51, 6004 Luzern in Switzerland.

FSM SMART (ARMIN ORDODARY'S BRAINCHILD)

As one of the oldest and most innovative Forex brokers in the world, FSMSmart has elevated the entire industry to new heights. Both FSMSmart and its operations manager, FSM Smart Ltd., are well-known in the financial services industry.

Over 140 countries worldwide have benefited from the Company's noteworthy and well-founded financial services thanks to its brave service and steadfast dedication.

Because of the company's vast market expertise and experience, FSMSmart provides top-notch services. As we enhance our existing technology to enable the vast and volatile industry to establish a reliable and sound trading system, we continue to give the enormous value of the market to our clients.

The Company's founding members, who have been in the brokerage and forex industries for more than 50 years and who have been directing and instilling values in FSMSmart from its foundation, are financial professionals and adept financial service providers.

FSM Smart is constantly coming up with new ideas and methods to ensure that our clients have a luxurious and fulfilling experience. In addition, the company strives to offer the finest possible trading circumstances and top-notch client support while carefully selecting Account Managers to ensure success in forex trading.

FINANCIAL CONDUCT AUTHORITY

The UK government has no control over the Financial Conduct Authority (FCA), a financial regulator that is funded by fees collected from participants in the financial services sector. The FCA protects the integrity of the UK financial markets by regulating financial companies that offer services to consumers.

It focuses on how financial services companies, both retail and wholesale, are expected to behave. Similar to the FSA, which it replaced, the FCA is set up as a company limited by guarantee.

To establish regulatory standards for the financial industry, the Financial Policy Committee, the Prudential Regulation Authority, and the FCA collaborate. The FCA is responsible for the conduct of around 58,000 businesses which employ 2.2 million people and contribute around £65.6 billion in annual tax revenue to the economy in the United Kingdom.

0 notes

Text

Cash for Cyprus! Maxiflex had to pay €370,000 due to potential infractions of the law.

Maxiflex has received allegations of being a major scam. Find out more about the company and its operations in this Gripeo review.

The CySEC declared on December 5, 2020, that a board decision had previously been made on October 5, 2020. It has to do with Israeli Roy Almagor’s Maxiflex Ltd. Maxiflex was required to pay the Republic of Cyprus Treasury €370,000. Although CySEC likes the phrase settlement money, reasonable people would refer to this as a penalty payment. As usual, the CySEC’s statement is incredibly evasive and fails to provide any context for the possible infraction Maxiflex may have committed. Lately, GlobalNetInt suspended the bank accounts of Almagor’s Maxiflex and Maxigrid after they were used as props in broker frauds.

In light of CySEC’s investigations, for potential infractions of The Investment Services and Activities and Regulated Markets Law of 2017, as these appeared between January 2019 and September 2020. More particular, the agreement agreed covered the evaluation of the Company’s adherence to:

Article22(1) of the Law addresses the authorization conditions of article 17(2),17(3), and 17(6) of the Law regarding the organisational requirements that a CIF must adhere to;

Article 24(1) of the Law addresses conflicts of interest; Article25, paragraphs (1) and (3) of the Law addresses general principles and information to clients;

Article26, paragraphs (2)(a) and (3)(a) of the Law addresses the evaluation of suitability and appropriateness and client reporting; and

Article28, paragraphs (1)(a) and (8) of the Law specify the duty to execute orders on terms that are most advantageous to the client.

A settlement of €370.000 has been made with the Company over potential infractions. The €370.000 has been paid by the Company. It should be highlighted that the sums payable under settlement agreements do not belong to CySEC and are instead regarded as revenue (income) of the Republic’s Treasury.

Maxiflex’s Infraction of the Law

Usually, an infraction is when someone violates a law, regulation, or agreement. Therefore, a country found guilty of breaking an international treaty will typically be required to pay a fine. A fee is the only punishment under federal law, where the offence is even less serious than a misdemeanour.

CySEC

Cyprus’s financial regulator is the Cyprus Securities and Exchange Commission, or CySEC for short. The European MiFID financial harmonisation law is complied with by CySEC’s financial regulations and operations as a member state of the EU.

A sizable portion of foreign retail forex brokers are registered with CySEC. Many binary options brokers had previously chosen CySEC as their regulator of choice before 2018.

As a public corporate organisation, CySEC was established in 2001 under section 5 of the Cyprus Securities and Exchange Commission (Establishment and Responsibilities) Law of 2001. CySEC joined the European MiFID regulation at the same time as Cyprus joined the EU in 2004, providing companies registered there access to all European markets. However, the financial regulatory structure that CySEC enforced for what was once thought to be a tax haven was drastically altered upon the EU’s membership and adoption of the Euro.

CySEC issued a regulatory change on May 4, 2012, pertaining to the categorization of binary options as financial instruments. As a result, platforms for binary options that are based in Cyprus—where the majority of them do—had to be subject to regulation. As a result, CySEC became the first financial regulator in the world to officially acknowledge and control binary options as financial instruments.

On July 10, 2019, CySEC permanently prohibited providing binary options trading to retail traders, following the implementation of a temporary ban on the products in July 2018.

Revocation of Maxiflex Ltd.’s authorization by the Cyprus Securities and Exchange Commission

In accordance with section 10(1) of Directive DI87-05 for The Withdrawal and Suspension of Authorization (“DI87-05”), the Cyprus Securities and Exchange Commission (“CySEC”) has notified the Malta Financial Services Authority that, as of October 15, 2021, it has completely suspended Maxiflex Ltd.’s authorization (“the Company”). This is because there are allegations of purported violations of:

According to Section 5(5) of the Investment Services and Activities and Regulated Markets Law of 2017 (the “Law”), the Company appears to be conducting business, engaging in business, and/or facilitating business not specifically authorised by the Company.

Article 22(1) of the Law since it appears that the Company does not always abide by the authorization criteria in sections 9(2) of the Law regarding the eligibility of management body members, 11(1)(b) regarding the suitability of shareholders, and 17(4) and (9) regarding organisational requirements.

As stipulated in section 9 of DI87-05 and for the duration that the suspension of authorization is in effect, the Company is not allowed to:

offer or carry out investment services or activities;

engage in any kind of business dealings with third parties and take on new clients;

promote itself as an investment services provider.

The following measures by the Company may be taken without violating section 7(a) of DI87-05, so long as they are in accordance with the desires of its current clients:

fulfil all of its clients’ and its own transactions that are in front of it, in compliance with client directives;

refund any money and financial instruments that belong to its clients.

The CySEC ruling of October 15, 2021, which is available on the CySEC website, provides more information about the aforementioned.

1 note

·

View note

Text

Armin Ordodary and the FSM Smart Fraud Allegations Fact-cheked (2024)

In March 2017, the media published a request for information regarding the broker fraud FSM Smart and its operator, Armin Ordodary. Indeed, we discovered a few noteworthy facts. We received confirmation that Armin Ordodary would just be a front for a larger organization after consulting with insiders. Shortly after we made the request, FSM Smart changed its domain name. Another reality is that the Scam Broker is still functioning on the internet. This is unacceptable, so we must reiterate our request for information.

Verified FSM Intelligence Regarding Armin Ordodary

Following the most recent call, we were informed that Armin Ordodary was the manager and founder of both the white-label broker platform provider NepCore and the SIAO Group. In the interim, both businesses have shut down their websites.

We have received confirmation that Armin Ordodary is a manager and shareholder of DOO, the upmarket Serbian company. This is purportedly a marketing firm that introduces fresh victims to broker scams, not a boiler room.

It has come to our attention that the Iranian-born resident of Cyprus and his businesses are merely a small component of a worldwide criminal network.

Information about the illicit broker scheme FSM Smart (www.fsmsmart.com) and its aggressive client acquisition strategy through Upmarket d.o.o., a Serbian boiler room, was provided to the media by whistleblowers. Berlin Holdings Ltd., a company based in Cyprus, is the only shareholder in this boiler room. Armin Ordodary, a resident of Cyprus, is a director of both companies.

The Warnings to Investors About Armin Ordodary

Early in 2018, the illicit broker was introduced. Currently, investors are advised not to participate in the FSM Smart scheme (www.fsmsmart.com and http://www.fsmsmarts.com).

The UK Financial Conduct Authority (FCA) warned investors against the plan in March of 2019.

ASIC, an Australian agency, warned investors not to participate in the broker scheme in April 2019.

August 2018: A warning was released by the Financial Markets Authority (FMA) of New Zealand;

October 2018: A warning was issued by FINMA, Switzerland’s financial market supervisory authority;

In November 2018, the Manitoba-based Canadian watchdog, MSC, issued a warning to investors about FSM Smart.

According to reports, the FSM Smart contact address is Hertensteinstrasse 51, 6004 Lucern in Switzerland.

FSM Smart (Armin Ordodary’s Brainchild)

As one of the oldest and most innovative Forex brokers in the world, FSMSmart has elevated the entire industry to new heights. Both FSMSmart and its operations manager, FSM Smart Ltd., are well-known in the financial services industry.

Over 140 countries worldwide have benefited from the Company’s noteworthy and well-founded financial services thanks to its brave service and steadfast dedication.

Because of the company’s vast market expertise and experience, FSMSmart provides top-notch services. As we enhance our existing technology to enable the vast and volatile industry to establish a reliable and sound trading system, we continue to give the enormous value of the market to our clients.

The Company’s founding members, who have been in the brokerage and forex industries for more than 50 years and who have been directing and instilling values in FSMSmart from its foundation, are financial professionals and adept financial service providers.

FSMSmart is constantly coming up with new ideas and methods to ensure that our clients have a luxurious and fulfilling experience. In addition, the company strives to offer the finest possible trading circumstances and top-notch client support while carefully selecting Account Managers to ensure success in forex trading.

Financial Conduct Authority

The UK government has no control over the Financial Conduct Authority (FCA), a financial regulator that is funded by fees collected from participants in the financial services sector. The FCA protects the integrity of the UK financial markets by regulating financial companies that offer services to consumers.

It focuses on how financial services companies, both retail and wholesale, are expected to behave. Similar to the FSA, which it replaced, the FCA is set up as a company limited by guarantee.

To establish regulatory standards for the financial industry, the Financial Policy Committee, the Prudential Regulation Authority, and the FCA collaborate. The FCA is responsible for the conduct of around 58,000 businesses which employ 2.2 million people and contribute around £65.6 billion in annual tax revenue to the economy in the United Kingdom.

0 notes

Text

Armin Ordodary and the FSM Smart Fraud (2024)

Media released a request for information about the broker fraud FSM Smart and its operator, Armin Ordodary, at the beginning of March 2017. We did, in fact, learn some important facts. After speaking with insiders, we were given the assurance that Armin Ordodary would merely serve as a front for a bigger organization. Not long after we requested it, FSM Smart modified its domain. The fact that the Scam Broker is still active online is another reality. We must reiterate our request for information because this is intolerable.

Verified FSM Intelligence Regarding Armin Ordodary

Following the most recent call, we were informed that Armin Ordodary was the manager and founder of both the white-label broker platform provider NepCore and the SIAO Group. In the interim, both businesses have shut down their websites.

We have received confirmation that Armin Ordodary is a manager and shareholder of DOO, the upmarket Serbian company. This is purportedly a marketing firm that introduces fresh victims to broker scams, not a boiler room.

It has come to our attention that the Iranian-born resident of Cyprus and his businesses are merely a small component of a worldwide criminal network.

Information about the illicit broker scheme FSM Smart (www.fsmsmart.com) and its aggressive client acquisition strategy through Upmarkt d.o.o., a Serbian boiler room, was provided to the media by whistleblowers. Benrich Holdings Ltd., a company based in Cyprus, is the only shareholder in this boiler room. Armin Ordodary, a resident of Cyprus, is a director of both companies.

The Warnings to Investors About Armin Ordodary

Early in 2018, the illicit broker was introduced. Currently, investors are advised not to participate in the FSM Smart scheme (www.fsmsmart.com and http://www.fsmsmarts.com).

The UK Financial Conduct Authority (FCA) warned investors against the plan in March of 2019.

August 2018: A warning was released by the Financial Markets Authority (FMA) of New Zealand;

October 2018: A warning was issued by FINMA, Switzerland’s financial market supervisory authority;

In November 2018, the Manitoba-based Canadian watchdog, MSC, issued a warning to investors about FSM Smart.

According to reports, the FSM Smart contact address is Hertensteinstrasse 51, 6004 Luzern in Switzerland.

FSM Smart (Armin Ordodary’s Brainchild)

As one of the oldest and most innovative Forex brokers in the world, FSMSmart has elevated the entire industry to new heights. Both FSMSmart and its operations manager, FSM Smart Ltd., are well-known in the financial services industry.

Over 140 countries worldwide have benefited from the Company’s noteworthy and well-founded financial services thanks to its brave service and steadfast dedication.

Because of the company’s vast market expertise and experience, FSMSmart provides top-notch services. As we enhance our existing technology to enable the vast and volatile industry to establish a reliable and sound trading system, we continue to give the enormous value of the market to our clients.

The Company’s founding members, who have been in the brokerage and forex industries for more than 50 years and who have been directing and instilling values in FSMSmart from its foundation, are financial professionals and adept financial service providers.

FSMSmart is constantly coming up with new ideas and methods to ensure that our clients have a luxurious and fulfilling experience. In addition, the company strives to offer the finest possible trading circumstances and top-notch client support while carefully selecting Account Managers to ensure success in forex trading.

Financial Conduct Authority

The UK government has no control over the Financial Conduct Authority (FCA), a financial regulator that is funded by fees collected from participants in the financial services sector. The FCA protects the integrity of the UK financial markets by regulating financial companies that offer services to consumers.

It focuses on how financial services companies, both retail and wholesale, are expected to behave. Similar to the FSA, which it replaced, the FCA is set up as a company limited by guarantee.

To establish regulatory standards for the financial industry, the Financial Policy Committee, the Prudential Regulation Authority, and the FCA collaborate. The FCA is responsible for the conduct of around 58,000 businesses which employ 2.2 million people and contribute around £65.6 billion in annual tax revenue to the economy in the United Kingdom.

1 note

·

View note

Text

ARMIN ORDODARY AND THE FSM SMART FRAUD (2024)

Media released a request for information about the broker fraud FSM Smart and its operator, Armin Ordodary, at the beginning of March 2017. We did, in fact, learn some important facts. After speaking with insiders, we were given the assurance that Armin Ordodary would merely serve as a front for a bigger organization. Not long after we requested it, FSM Smart modified its domain. The fact that the Scam Broker is still active online is another reality. We must reiterate our request for information because this is intolerable.

VERIFIED FSM INTELLIGENCE REGARDING ARMIN ORDODARY

Following the most recent call, we were informed that Armin Ordodary was the manager and founder of both the white-label broker platform provider NepCore and the SIAO Group. In the interim, both businesses have shut down their websites.

We have received confirmation that Armin Ordodary is a manager and shareholder of DOO, the upmarket Serbian company. This is purportedly a marketing firm that introduces fresh victims to broker scams, not a boiler room.

It has come to our attention that the Iranian-born resident of Cyprus and his businesses are merely a small component of a worldwide criminal network.

Information about the illicit broker scheme FSM Smart (www.fsmsmart.com) and its aggressive client acquisition strategy through Upmarkt d.o.o., a Serbian boiler room, was provided to the media by whistleblowers. Benrich Holdings Ltd., a company based in Cyprus, is the only shareholder in this boiler room. Armin Ordodary, a resident of Cyprus, is a director of both companies.

THE WARNINGS TO INVESTORS ABOUT ARMIN ORDODARY

Early in 2018, the illicit broker was introduced. Currently, investors are advised not to participate in the FSM Smart scheme (www.fsmsmart.com and http://www.fsmsmarts.com).

The UK Financial Conduct Authority (FCA) warned investors against the plan in March of 2019.

ASIC, an Australian agency, warned investors not to participate in the broker scheme in April 2019.

August 2018: A warning was released by the Financial Markets Authority (FMA) of New Zealand;

October 2018: A warning was issued by FINMA, Switzerland’s financial market supervisory authority.

In November 2018, the Manitoba-based Canadian watchdog, MSC, issued a warning to investors about FSM Smart.

According to reports, the FSM Smart contact address is Hertensteinstrasse 51, 6004 Luzern in Switzerland.

FSM SMART (ARMIN ORDODARY’S BRAINCHILD)

As one of the oldest and most innovative Forex brokers in the world, FSMSmart has elevated the entire industry to new heights. Both FSMSmart and its operations manager, FSM Smart Ltd., are well-known in the financial services industry.

Over 140 countries worldwide have benefited from the Company’s noteworthy and well-founded financial services thanks to its brave service and steadfast dedication.

Because of the company’s vast market expertise and experience, FSMSmart provides top-notch services. As we enhance our existing technology to enable the vast and volatile industry to establish a reliable and sound trading system, we continue to give the enormous value of the market to our clients.

The Company’s founding members, who have been in the brokerage and forex industries for more than 50 years and who have been directing and instilling values in FSMSmart from its foundation, are financial professionals and adept financial service providers.

FSMSmart is constantly coming up with new ideas and methods to ensure that our clients have a luxurious and fulfilling experience. In addition, the company strives to offer the finest possible trading circumstances and top-notch client support while carefully selecting Account Managers to ensure success in forex trading.

FINANCIAL CONDUCT AUTHORITY

The UK government has no control over the Financial Conduct Authority (FCA), a financial regulator that is funded by fees collected from participants in the financial services sector. The FCA protects the integrity of the UK financial markets by regulating financial companies that offer services to consumers.

It focuses on how financial services companies, both retail and wholesale, are expected to behave. Similar to the FSA, which it replaced, the FCA is set up as a company limited by guarantee. To establish regulatory standards for the financial industry, the Financial Policy Committee, the Prudential Regulation Authority, and the FCA collaborate. The FCA is responsible for the conduct of around 58,000 businesses which employ 2.2 million people and contribute around £65.6 billion in annual tax revenue to the economy in the United Kingdom.

1 note

·

View note

Text

Armin Ordodary and the FSM Smart Fraud (2024)

Media released a request for information about the broker fraud FSM Smart and its operator, Armin Ordodary, at the beginning of March 2017. We did, in fact, learn some important facts. After speaking with insiders, we were given the assurance that Armin Ordodary would merely serve as a front for a bigger organization. Not long after we requested it, FSM Smart modified its domain. The fact that the Scam Broker is still active online is another reality. We must reiterate our request for information because this is intolerable.

Verified FSM Intelligence Regarding Armin Ordodary

Following the most recent call, we were informed that Armin Ordodary was the manager and founder of both the white-label broker platform provider NepCore and the SIAO Group. In the interim, both businesses have shut down their websites.

We have received confirmation that Armin Ordodary is a manager and shareholder of DOO, the upmarket Serbian company. This is purportedly a marketing firm that introduces fresh victims to broker scams, not a boiler room.

It has come to our attention that the Iranian-born resident of Cyprus and his businesses are merely a small component of a worldwide criminal network.

Information about the illicit broker scheme FSM Smart (www.fsmsmart.com) and its aggressive client acquisition strategy through Upmarkt d.o.o., a Serbian boiler room, was provided to the media by whistleblowers. Benrich Holdings Ltd., a company based in Cyprus, is the only shareholder in this boiler room. Armin Ordodary, a resident of Cyprus, is a director of both companies.

The Warnings to Investors About Armin Ordodary

Early in 2018, the illicit broker was introduced. Currently, investors are advised not to participate in the FSM Smart scheme (www.fsmsmart.com and http://www.fsmsmarts.com).

The UK Financial Conduct Authority (FCA) warned investors against the plan in March of 2019.

August 2018: A warning was released by the Financial Markets Authority (FMA) of New Zealand;

October 2018: A warning was issued by FINMA, Switzerland’s financial market supervisory authority;

In November 2018, the Manitoba-based Canadian watchdog, MSC, issued a warning to investors about FSM Smart.

According to reports, the FSM Smart contact address is Hertensteinstrasse 51, 6004 Luzern in Switzerland.

FSM Smart (Armin Ordodary’s Brainchild)

As one of the oldest and most innovative Forex brokers in the world, FSMSmart has elevated the entire industry to new heights. Both FSMSmart and its operations manager, FSM Smart Ltd., are well-known in the financial services industry.

Over 140 countries worldwide have benefited from the Company’s noteworthy and well-founded financial services thanks to its brave service and steadfast dedication.

Because of the company’s vast market expertise and experience, FSMSmart provides top-notch services. As we enhance our existing technology to enable the vast and volatile industry to establish a reliable and sound trading system, we continue to give the enormous value of the market to our clients.

The Company’s founding members, who have been in the brokerage and forex industries for more than 50 years and who have been directing and instilling values in FSMSmart from its foundation, are financial professionals and adept financial service providers.

FSMSmart is constantly coming up with new ideas and methods to ensure that our clients have a luxurious and fulfilling experience. In addition, the company strives to offer the finest possible trading circumstances and top-notch client support while carefully selecting Account Managers to ensure success in forex trading.

Financial Conduct Authority

The UK government has no control over the Financial Conduct Authority (FCA), a financial regulator that is funded by fees collected from participants in the financial services sector. The FCA protects the integrity of the UK financial markets by regulating financial companies that offer services to consumers.

It focuses on how financial services companies, both retail and wholesale, are expected to behave. Similar to the FSA, which it replaced, the FCA is set up as a company limited by guarantee.

To establish regulatory standards for the financial industry, the Financial Policy Committee, the Prudential Regulation Authority, and the FCA collaborate. The FCA is responsible for the conduct of around 58,000 businesses which employ 2.2 million people and contribute around £65.6 billion in annual tax revenue to the economy in the United Kingdom.

0 notes